Accounting for SALT Cap Workarounds

In 2017, the Tax Cuts and Jobs Act (TCJA) imposed a $10,000 limitation on the deductibility of state and local income tax (SALT) payments made by individuals. This limitation, commonly referred to as the “SALT cap,” severely limited the itemized deductions of many individual taxpayers.

In response to this limitation, approximately 20 states have adopted workarounds, known as pass-through entity taxes (PTETs), which allow pass-through business owners to maximize their eligible deductions subject to the SALT cap. IRS Notice 2020-75, issued in 2020, offered further guidance clarifying the intention to permit state PTETs as a workaround to the SALT cap for individual taxpayers who own pass-through entities such as partnerships, S corporations and some LLCs.

How to Account for a PTET

The Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) 740, Income Taxes, provides guidance on the accounting treatment for taxes assessed on pass-through entities. The first step is determining whether the taxes paid by the entity are attributable to the individual shareholders or owners, or if the taxes are attributable to the entity. This determination is dictated by the laws and regulations of the jurisdiction where the entity is subject to income taxes.

PTET is Attributable to the Entity

If the PTET is attributable to the entity, the transaction is accounted for as a charge to the entity’s operations, similar to other income taxes and consistent with the guidance for uncertainty in income taxes in FASB ASC, Topic 740. For example, if the state’s jurisdiction has no provision for the shareholders or owners to file tax returns and the laws of the state’s jurisdiction do not indicate that the payments are made on behalf of the shareholders or owners, the PTET is attributed to the entity.

Deferred Tax Assets and Liabilities for State and Local Income Taxes (FASB ASC 740-10-55-25)

If the PTET is attributable to an entity and the entity made the PTET election during 2021, then the entity is liable for the tax as of year-end. There will likely be instances where estimated PTET payments are different than the actual PTET expense. The entity should establish if the differences are material and, if so, may want to consider adjusting the PTET expense to actual for reporting purposes on their 2021 financial statements. In a scenario where the entity determines there are material differences between its estimated payments and the actual PTET expense, deferred tax assets or liabilities related to PTET should be recognized:

-

- If PTET was underpaid at year-end, the entity should accrue an additional tax provision and deferred tax liability for the year ended December 31, 2021.

- If PTET was overpaid and a refund is anticipated at year-end, the entity should recognize a deferred tax asset for the year ended December 31, 2021.

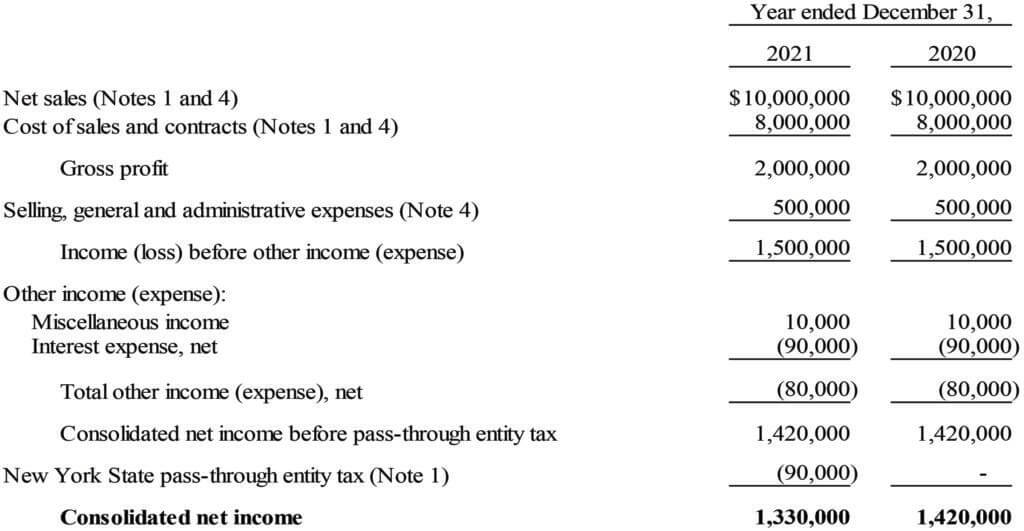

Financial Statement Presentation

Most of our clients in New York State have determined the PTET to be assessed at the entity level and are treating the PTET as an expense. This is presented on the financial statement as follows:

PTET is Attributable to the Owners

If the PTET is attributable to the individual shareholders or owners, the transaction is accounted for as an equity transaction.

Similar to evaluating for deferred tax assets and liabilities, as previously described, if a PTET is attributable to the owners and estimated PTET payments are found to be materially different from the final PTET, owners may want to consider accruing additional equity transactions for the year ended December 31, 2021, to reflect additional distributions to be taken or contributions to be made in the event of anticipated additional payments or refunds.

Learn More

It is important for taxpayers to separately evaluate state entity-level elections in the context of both their specific tax structure and the filing positions of their members. As states trend to adopt PTETs as a workaround to the SALT cap, significant opportunities arise for taxpayers. Pass-through entities should continue to monitor the progress of SALT cap issues in their respective states, be mindful of the timing of the tax payments giving rise to the deduction and ensure they are properly accounting for the payments.

If you are interested in learning more about accounting for your company’s PTET election, please contact us, and we can help you navigate recording the transactions related to this tax-saving strategy.

Contributing author: Robert Reeves, CPA, is an audit manager with over seven years of experience providing audit, review, compilation and consulting services to a variety of clients with a focus in the manufacturing, construction and architectural and engineering industries. Bob also specializes in providing auditing services to a variety of employee benefit plans and working with clients to help identify and resolve accounting issues.