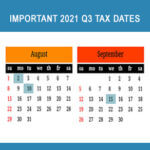

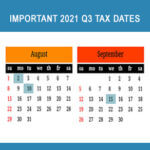

2021 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list…

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list…

It takes more than dedication and enthusiasm for your not-for-profit’s cause and programs to make a good board member. The most critical duty for all…

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or…

Fraud perpetrators take whatever they can get their hands on. But they generally prefer cash because it’s virtually untraceable. Fortunately, fraud experts have the expertise…

Over the last year, many companies have experienced “workforce fluctuations.” If your business has engaged independent contractors to address staffing needs, be careful that these…

The Consolidated Appropriations Act (CAA), signed into law late last year, contains a multitude of provisions that may affect individuals. For example, if you’re planning…

If you share a vacation home with family members, holding it in a limited liability company (LLC) is one option that offers several important benefits.…

While the pandemic has forced many businesses to close, it has also created a multitude of opportunities for the creation of new businesses entering the…

The IRS recently released guidance providing the 2022 inflation-adjusted amounts for Health Savings Accounts (HSAs). Fundamentals of HSAs An HSA is a trust created or…

If your business is organized as a sole proprietorship or as a wholly owned limited liability company (LLC), you’re subject to both income tax and…